What Is No-Fault Insurance?

Personal injury protection (PIP) coverage is often referred to as no-fault insurance. This coverage helps pay for medical costs and other expenses after a car collision, regardless of who was at fault for the accident. Several states, including Florida, New Jersey, and New York, require vehicle owners to have PIP coverage as part of their auto insurance.

The state where you live determines the minimum policy limits you must carry and what coverages are available. You may also have an opportunity, in some states, to elect a deductible, co-payment, additional policy limit, or health care primary option.

PIP insurance may provide the following benefits:

While this type of personal injury insurance helps cover many areas, there are certain exclusions you should know. PIP generally doesn’t cover the following:

- Medical expenses

- Wage Lost while being treated

- Household services you are unable to perform, such as child or senior care

- Death Benefit

Coverage benefits and restrictions differ in each state. For example, PIP “follows the car” in some states, while in other states, PIP coverage “follows the person.” This can impact how coverage is applied to you as the driver, a passenger, or a pedestrian. Consult with your insurance agent for more details about PIP coverage and what it includes.

What Does Personal Injury Protection Cover?

PIP typically covers the following areas:

- Medical bills: These expenses can include ambulance rides, hospital stays, follow-up doctor visits, and prescription medications.

- Lost wages: If your injuries keep you from working, PIP can replace part of your income while you heal.

- Rehab and recovery: Coverage usually extends to physical or occupational therapy, so you can get back on your feet faster.

- Essential services: If you can’t take care of household tasks, PIP may help pay for things like childcare, cleaning, or lawn care.

- Funeral and survivor benefits: In tragic cases, PIP can help cover funeral expenses and provide benefits to your loved ones.

Coverage details and limits vary by state, and some states allow you to customize your PIP with options like higher benefit limits or lower deductibles. An insurance agent can walk you through what’s available where you live and help you choose the right protection.

What Does PIP Insurance Not Cover?

While this type of personal injury insurance helps cover many areas, there are certain exclusions you should know. PIP generally doesn’t cover the following:

- Damage to vehicles or property: PIP won’t pay to fix your car or someone else’s. That’s where collision protection or liability protection comes in.

- Pain and suffering: PIP covers concrete costs like medical bills and lost wages, but not compensation for emotional distress or loss of enjoyment.

- Intentional or criminal acts: If an injury happens while committing a crime or as a result of an intentional act, it won’t be covered.

- Non-accident injuries: If you’re hurt in an unrelated incident, like a sports injury or slip-and-fall, PIP doesn’t apply.

- Work-related injuries: Accidents that happen while you’re on the job are usually handled through workers’ compensation, not PIP.

- Costs above your policy limits: Once you reach your PIP coverage limit, any remaining costs will need to be paid through health insurance or out-of-pocket.

Drivers save hundreds* when switching to Mercury Insurance.

*Individual savings may vary.

What Are the Benefits of PIP Insurance Coverage?

Personal injury protection insurance offers fast, reliable help after a car accident, no matter who was at fault. Here’s a quick breakdown of PIP’s benefits:

|

Benefit |

What it covers |

|

Medical expenses |

Doctor visits, hospital stays, surgeries, X-rays, prescriptions, and rehabilitation services like physical therapy. |

|

Lost wages |

A portion of your income if you can’t work while recovering from injuries. |

|

Household and essential services |

Childcare, housekeeping, yard work, or other services you can’t perform due to injury. |

|

Death and funeral benefits |

Funeral, burial, or cremation costs, plus benefits for surviving dependents in some states. |

Coverage benefits and restrictions differ in each state. For example, PIP “follows the car” in some states, while in other states, PIP coverage “follows the person.” This can impact how coverage is applied to you as the driver, a passenger, or a pedestrian. Consult with your insurance agent for more details about PIP coverage and what it includes.

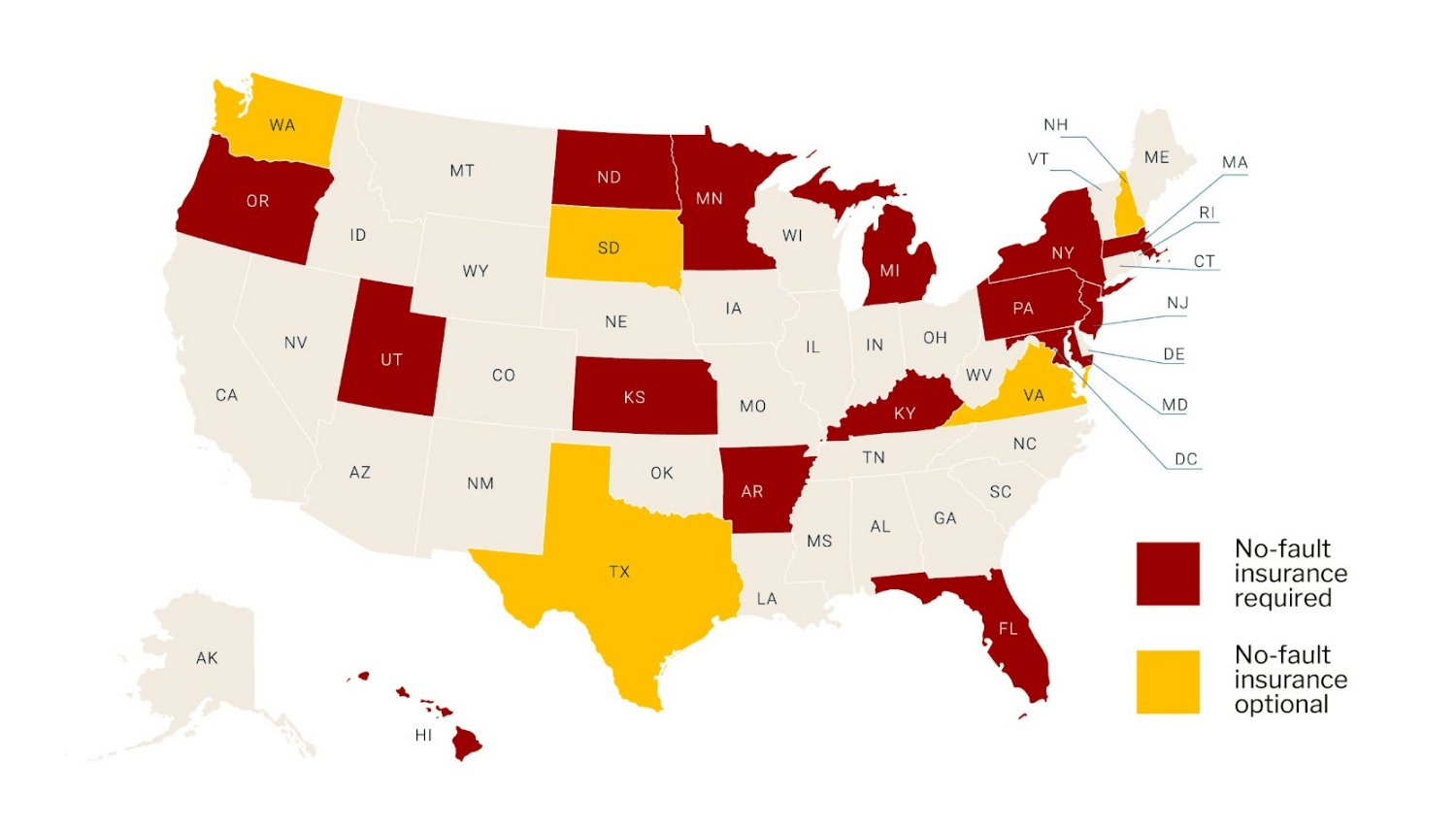

Which States Are No-Fault States?

In the U.S., 12 states follow a no-fault insurance system, meaning drivers must carry PIP coverage and file accident-related claims with their own insurer, regardless of who caused the accident.

- Florida

- Hawaii

- Kansas

- Kentucky

- Massachusetts

- Michigan

- Minnesota

- New Jersey

- New York

- North Dakota

- Pennsylvania

- Utah

In no-fault states, you generally can’t sue the other driver for injuries unless the accident meets certain serious injury or cost thresholds.

Also, Kentucky, New Jersey, and Pennsylvania are “choice” no-fault states. This means drivers can stick with the default no-fault system—which includes PIP coverage and limits the right to sue for pain and suffering—or opt for traditional tort coverage, which preserves full lawsuit rights but typically forgoes some no-fault benefits.

What Limits Should I Have for Personal Injury Protection?

The right PIP limit depends on where you live, your health insurance, and how much protection you want.

If you live in a no-fault state, you’re required by law to carry a certain level of PIP coverage. These minimums differ depending on your location. For example, Texas requires $2,500, while New York mandates $50,000 per person. However, the minimum may not cover all your medical bills, lost wages, or household help after a serious accident.

Your health insurance plays a key role here, too. If you have strong health coverage with a low deductible, you may not need a high PIP limit. On the flip side, if your deductible is high or your health plan doesn’t cover lost wages or household services, a higher PIP can fill that gap.

When in doubt, ask your insurance agent to help you find a limit that fits your state’s rules, your lifestyle, and your financial comfort zone.

Frequently Asked Questions About No-Fault Insurance

Does PIP coverage cover theft?

No. PIP only covers injury-related expenses like medical bills, lost wages, and certain household services after a crash. Theft and other property damage are covered under comprehensive insurance, not PIP.

Does personal injury protection cover car damage?

No, PIP doesn’t handle repairs. It’s meant to cover your injuries and recovery costs after a crash. To fix your car, you’ll need collision coverage or the at-fault driver’s property damage liability coverage.

How does no-fault insurance work?

In a no-fault system, you turn to your own insurance for injury-related expenses, no matter who caused the accident. This means faster payouts and less back-and-forth about fault, though you can still sue in certain serious cases.

What does a no-fault state mean?

A no-fault state requires drivers to carry PIP and file injury claims with their own insurer first. This limits the ability to sue the other driver except in serious injury or high-cost situations.

What are the differences between a no-fault state and a fault state regarding insurance claims?

In no-fault states, everyone’s own insurer pays for their injury costs. In fault states, the at-fault driver’s insurance pays for the other person’s injuries and damages.

What happens if someone else is driving my car and they get into an accident?

In most cases, insurance follows the car, not the driver. So if a friend borrows your car and crashes, your policy (including PIP, if you have it) may still apply. However, rules vary by state and policy, so it’s smart to double-check with your insurer.