Auto insurance is a requirement of vehicle ownership in most of the U.S., so drivers need to account for it in their household budgets. Occasionally, auto insurance rates will increase seemingly inexplicably, leaving you confused and frustrated. However, insurance rates won’t increase for no reason. Read on to get answers to the question: ‘Why did my car insurance go up?’

What Is a Car Insurance Premium?

A car insurance premium is the amount you pay your insurance company for auto coverage. Depending on what your insurer provides, this payment may be monthly, biannually, or annually. The amount you pay depends on the coverage you choose and other factors (more on this later). It’s also important to note that your car insurance premium differs from your deductible — the out-of-pocket amount you pay for a claim before your insurer helps out.

Why Are Car Insurance Rates Going Up?

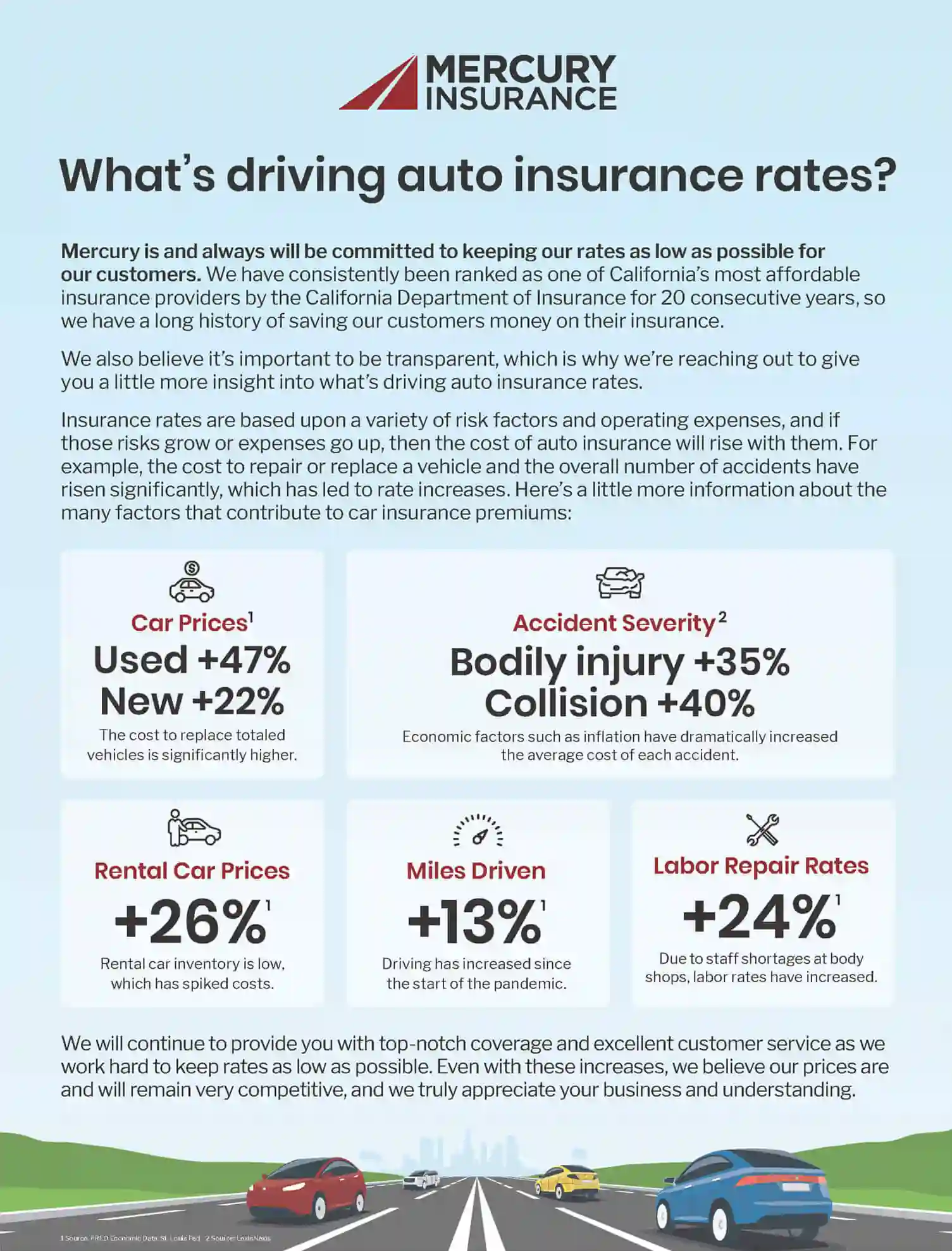

If you’ve noticed your auto insurance bill has increased recently, you’re not alone. According to the U.S. Bureau of Labor Statistics, car insurance rates were up about 15% in March 2023 compared to a year earlier.

So why is this happening? It boils down to inflation. Auto repair costs — both parts and labor — have increased due to labor shortages and supply chain issues. This leads to longer repair times, which results in costlier claims. When determining premiums, the auto insurance industry periodically needs to make adjustments to account for the money paid out for repairs and replacements for all customers.

Why Did My Car Insurance Go Up? Factors to Consider

Aside from inflation, other components can affect your car insurance premium. Here are some of the factors you can and can’t control.

Factors You Can Control

- Credit Score: If your credit score decreases, your insurer may increase your premium. To help keep your score at bay, make your payments on time, keep credit utilization low, and avoid unnecessary credit inquiries.

- Driving Record: Drivers with a clean driving record pay less for their premium than those who have been in a collision or have been cited for traffic violations because good drivers tend to be lower risk and less likely to need to file an insurance claim.

- The Vehicle You Drive: Generally, newer cars cost more to repair following an accident. They’re also at a higher risk for thefts or break-ins. If you’re thinking of purchasing a new car, consider talking to your insurer first to see how it may affect your premium.

- Your Location: If you’re planning a big move, it’s important to know your location can impact your premium. From California to New York, all states have varying car insurance rates because insurance companies look at geographic factors such as crime rate, number of auto accidents, and weather conditions to determine your premium.

- Miles You Drive: The more you drive, the more likely you will get into an accident. If you’re starting to drive less, let your insurer know because they may lower your premium.

Factors You Can’t Control

- Your Age: Insurance companies consider teens and seniors riskier drivers, so they often pay more for auto insurance than other drivers in different age groups.

- Loss of Discounts: Auto insurance discounts are a great way to help lower your car insurance. However, when you renew your policy, some discounts may no longer be available. Or perhaps, you’re no longer eligible for it. For example, Mercury offers a good student discount, but if your child graduates and no longer attends school, they would be ineligible for this discount.

- Your Gender: Gender is a factor that can influence car insurance premiums. According to the Insurance Information Institute, women tend to get into fewer accidents and DUIs than men, so women often pay less for auto insurance than males.

Conclusion

If your car insurance rate goes up, it could be because of factors beyond your control — e.g., inflation, age, gender, etc. However, there are ways you can lower your premium by yourself, such as improving your credit score, being a good driver, and driving less. You can also take advantage of Mercury’s auto insurance discounts to help keep your premium affordable.

Contact us today for a fast, free quote!

Frequently Asked Questions About Why Car Insurance Rates Increase

Is it normal for car insurance to increase?

Due to changes in insurance risk, it’s normal for insurance rates to increase. For instance, if your zip code had a spike in accidents and violations over a certain period, your insurer may increase your premium to reflect that risk.

Why did my car insurance go up after renewal?

Different factors, such as increased accidents and violations in your area, can cause higher insurance rates at renewal. Consider speaking with your insurer to find out why your premium increased.

Why did my car insurance go up without an accident?

Your location is a key factor insurers look at when determining your premium. So although you may not have gotten into an accident recently, other drivers in your area may have.

What age does car insurance go down?

According to PolicyGenius, car insurance rates decrease every time you renew your policy — assuming you’re a good driver. However, as a general rule of thumb, car insurance premiums tend to decrease when you turn 25.