With U.S. housing prices continuing to climb in many regions and the economy’s uncertainty, many prospective buyers are finding it harder to take the leap into homeownership. Yet, the dream of owning a home is still alive and well for many Americans.

But where in America is the homeownership dream the most alive and well? Does homebuying optimism depend on where you live? And how do our motivations for homebuying vary according to the state we reside in?

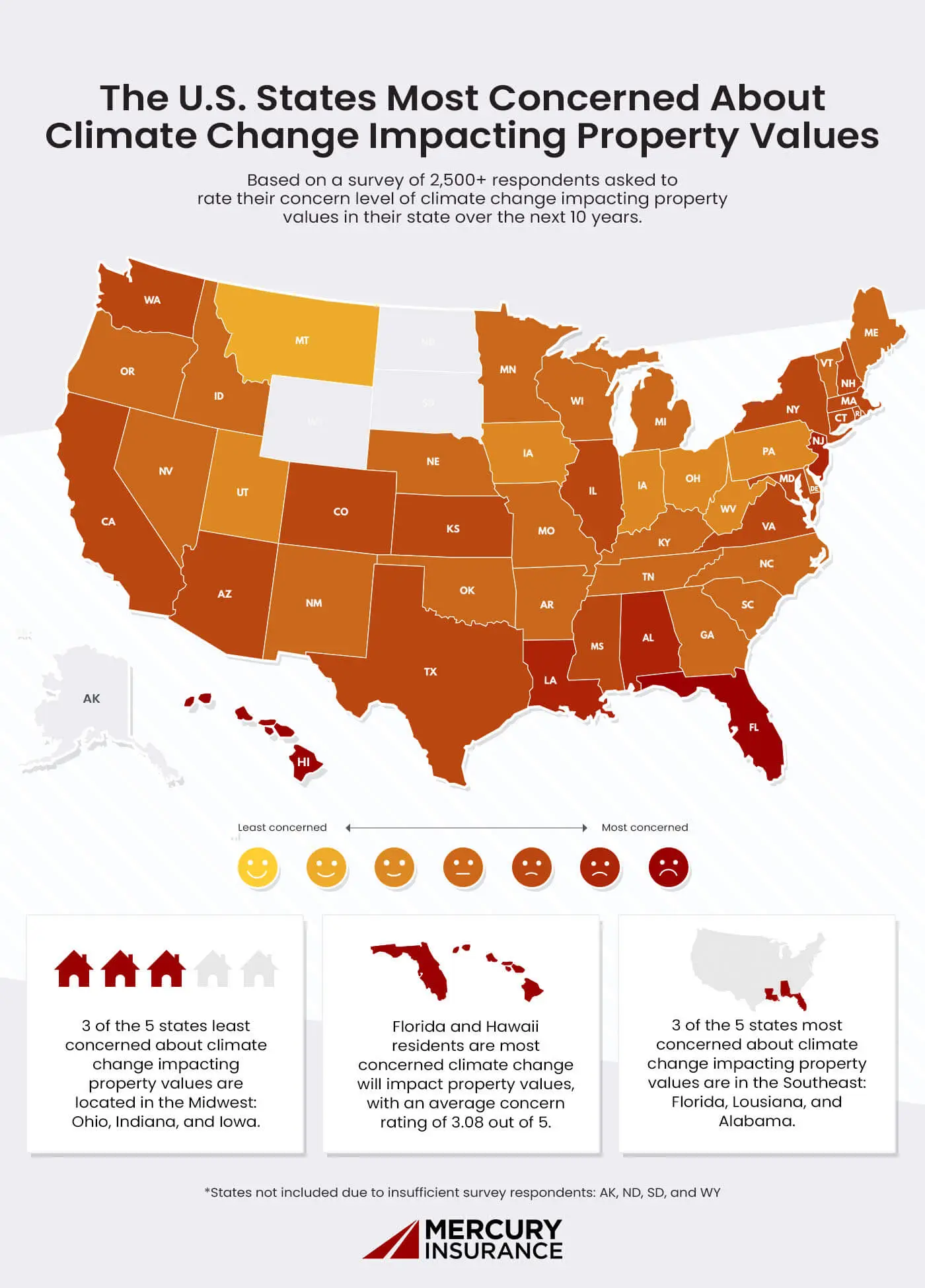

Using our latest survey insights from 2,500 prospective homebuyers across 46 states, we’ll uncover the key drivers and challenges shaping homebuying decisions across the country. From factors motivating buyers to take the plunge to the reasons holding others back, we’ll explore what’s influencing these important decisions.

Key Findings

- The top homebuying deterrent across the U.S. is high house prices in desired areas, followed by economic instability and current high interest rates.

- The top homebuying motivator across the U.S. is the desire for privacy and space, followed by control over property personalization and high rent costs.

- California ranks as the least optimistic state about future homeownership, with an average confidence rating of 3.17 out of 10 for homeownership in the next five years. Following closely are Maine and Wisconsin.

- Tennessee ranks as the most optimistic state about future homeownership, with an average confidence rating of 5.84 out of 10 for homeownership in the next five years. Delaware, South Carolina, and Alabama also express higher levels of optimism.

- Hawaii, Massachusetts, and Utah are the states where residents find the housing market least affordable, with only 1.92% of respondents able to afford homeownership.

- Oklahoma and Arkansas residents find the housing market most affordable, with over 50% agreeing with this sentiment.

- 3 of the 5 states most concerned about climate change impacting their property values are located in the Southeast: Florida, Louisiana, and Alabama.

- Florida and Hawaii residents are most concerned that climate change will impact future property values in their state, with an average concern rating of 3.08 out of 5.

Top Homebuying Deterrents Across the U.S.

In 2024, several key factors are preventing many Americans from taking the leap into homeownership, including affordability, economic uncertainty, and rising interest rates.

High Housing Prices

The high cost of housing is the number one deterrent for potential homebuyers. This issue is widespread, but it’s especially prevalent in states like California, Hawaii, and Massachusetts, where property values are among the highest in the nation.

In California, a long-standing housing shortage, strict building codes, and rising labor costs have caused prices to skyrocket. With the median home price sitting around $787,000, it’s no surprise that California ranks as the state with the least optimism for future homeownership.

In Hawaii, strict regulations and the demand for vacation rentals have made the housing shortage even worse. The median home price has surged by 260% since 2000, leaving residents facing prices nearing $750,000 — a figure that makes owning a home almost impossible for many locals.

Massachusetts is also grappling with high prices and low inventory. The state’s housing supply dropped by 18.7% between July and September 2023, pushing prices up more than 50% since 2020. These trends and the median price of $601,000 have left many first-time buyers with limited options

Economic Instability

Economic uncertainty is another reason why potential homebuyers are holding off on purchasing a home. In fact, it’s cited as the number one deterrent to homeownership in the states of Louisiana, Mississippi, Oklahoma, South Carolina, Vermont, and West Virginia. Job uncertainty, fluctuating wages, and the overall fear of an economic downturn might be prompting many would-be buyers to take a “wait and see” approach.

Even in states with relatively affordable housing markets like Oklahoma and Mississippi, the economy’s unpredictability outweighs the appeal of lower prices. For residents in South Carolina and Vermont, economic worries are top of mind, despite the latter being one of the most optimistic states about future homeownership.

High Interest Rates

Rising interest rates also make it harder for many people to buy homes. The increase in rates has made monthly mortgage payments much more expensive, and this is especially true in states with already high home prices, like California, Connecticut, and Florida.

In California, where the median home price is around $760,000, higher interest rates can add thousands of dollars to a mortgage, making it even harder for first-time buyers to afford a home. Similarly, in Connecticut, where the cost of living is high, rising rates may be pushing more people out of the market and forcing many to delay their buying plans.

Even in states like Florida, where the housing market is more diverse, rising interest rates may be discouraging potential buyers, especially in coastal areas where property values are rising quickly.

Top Homebuying Motivators Across the U.S.

Despite economic challenges, many U.S. residents are still motivated to buy homes in 2024. The 2,500 respondents were asked to select their top three homebuying motivators from a list of 10 options, from building equity to societal expectations and everything in between.

Here are the key reasons driving their decisions:

Privacy and Space

The number one motivator for homebuyers across most states is the desire for more privacy and space. After the pandemic, people are looking for homes that offer personal space, both indoors and outdoors. Remote work may have also pushed buyers to prioritize larger homes where they can have dedicated workspaces.

Control Over Property Personalization

Another strong motivator is the freedom to customize a home. Many buyers want the ability to make their space their own — whether it’s through renovations, landscaping, or decor. Owning a home gives them the control they can’t get from renting. This is especially important for younger buyers eager to invest in properties they can personalize over time.

The Role of Climate Change in Homebuying Decisions

As climate change leads to more frequent and severe weather events, it’s becoming a factor for homebuyers concerned about how these changes could potentially impact their property values and safety.

States Most Concerned About Climate Change

- Florida: Buyers in Florida may be worried about rising sea levels and hurricanes, which are severe threats to property values in the state.

- Hawaii: The concern in Hawaii focuses on rising sea levels and land erosion, suggesting many people are hesitant to invest in coastal properties due to the high risk of damage.

- New Jersey and Louisiana: In these states, homebuyers might be particularly anxious about the long-term effects of climate change, such as flooding and hurricanes, on their property investments.

States Least Concerned About Climate Change

- Montana: Montana shows the least concern nationally, likely because its geographical location minimizes the risk of severe climate-related disasters like hurricanes or large-scale flooding.

- West Virginia: With fewer severe weather incidents, West Virginia residents likely worry less about climate change affecting their homes.

- Ohio: Like West Virginia, Ohio’s lower concern is probably due to experiencing fewer extreme weather events that would impact property values.

Conclusion

While there are plenty of challenges homebuyers face — like high housing prices, economic uncertainty, and rising interest rates — the desire for more privacy, the ability to make a home truly your own, and the need for a secure environment continue to drive many Americans toward owning a home.

If you’re in the market for a home, there are several expenses beyond the purchase price you have to consider, including homeowners insurance. That’s where Mercury Insurance can help. Our affordable home insurance makes it easy to get the coverage you need without breaking the bank. We offer peace of mind by protecting your home so you can focus on enjoying your new space rather than worrying about what could go wrong.

Whether you’re buying your first home or upgrading to your dream house, our home insurance will help keep your property well-protected.

Methodology

Mercury Insurance conducted a survey of 2,500 people across 46 states in the summer of 2024 under the following criteria:

- They do not currently own a home

- They want to buy a home in the next five years

- They reside in the United States