Following a Collision with an Automated Vehicle, What Do You Do?

Seven out of ten drivers wouldn’t know what to do

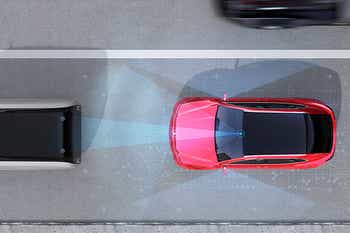

Drivers today share the road with automated vehicles* more and more, with tech companies like Amazon, Apple, Google, Intel and just about every automaker developing and testing self-driving cars and trucks. Auto manufacturers are phasing automated vehicle technologies into new models, including adaptive cruise control, collision avoidance, blind spot cameras, parking assistance and lane departure warning systems. These semi-automated technologies are the first steps toward a fully-automated vehicle future.

Full automated vehicle adoption won’t happen overnight, as these vehicles are only expected to account for five percent of all vehicles sold by 2030. Companies are testing their technology around the country, and government agencies are working diligently to study and implement regulations governing the use of driverless vehicles.

As this transition takes place, there will still be car collisions, and many will involve automated and old-fashioned human-controlled vehicles. Typically, drivers involved in a collision exchange vehicle and insurance information with one another. But what does one do when there’s no driver in the automated vehicle?

A 2018 nationwide study conducted by Mercury Insurance revealed that 70 percent of Americans wouldn’t know what to do if they were involved in an accident involving an automated vehicle. Even more perplexing is what to do if an automated vehicle hits you or your vehicle and drives away from the scene – a recent incident caught on video during the 2019 Consumer Electronics Show in Las Vegas shows this exact scenario and it’s a potential problem both manufacturers and consumers need to prepare for as we get closer to self-driving vehicles becoming a mainstay on the nation’s roadways.

“Drivers involved in a ‘hit-and-run’ incident with an automated vehicle should proceed the same way they would if there was someone behind the wheel,” says Kevin Quinn, Vice President of Claims and Customer Experience at Mercury Insurance. “Try to get the license plate, make, model and color of the vehicle and call the police. We can identify the vehicle from the plate, but whether you get the plate or not, call the police and report a hit and run accident immediately.”

Mercury Insurance recommends taking the following actions if you’re ever involved in a collision with an automated vehicle:

- Move to a safe area immediately. If you are unable to move the vehicle, turn on the vehicle hazard lights to warn other drivers. If you have road safety flares, use them.

- Park your vehicle and get out if you can. First, turn off the engine and then make sure it is safe to exit your vehicle.

- Ensure everyone involved in the collision is okay. If someone is injured, call 9-1-1 immediately. Calling law enforcement to the scene is also recommended whether someone is injured or not.

- Gather as much information as you can, including the year, make and model, plus the license plate number(s) and vehicle identification number (VIN) of all vehicles involved. “The key is to get a photo of the VIN, license plate, and make and model of the other vehicle, if safe to do so,” says Quinn. “Smartphones make it easy to take photos of the accident scene and the vehicles involved. A photo is ideal but writing down the information works, too.”

- Get the names and contact information of any witnesses, and be sure to note the date, time and location of the accident. Record which direction each vehicle was heading at the time of the crash. “The more information you’re able to provide to police or your insurance company, the easier it will be for them to reconstruct exactly what happened and determine who’s at fault,” says Quinn. “In the case of colliding with an automated vehicle, take photos and video of the weather conditions.”

- Get the badge number of responding law enforcement officers when they arrive, and be sure to find out how and when you can obtain a copy of their report. The officer may be able to give you an accident report number at the scene.

- Call your insurance company to file a claim as soon as possible. Note the name of the insurance adjuster handling your claim, date and time of the call and your claim number. They will need the same information provided to the police. Even if you’re in a minor fender bender, report it so you’re protected against unforeseen or future claims, because sometimes injuries and damage aren’t readily apparent. You should also make your personal insurance agent aware of the accident, as he or she can help spot red flags and help resolve problems.

If a hit-and-run incident occurs, it’s still important for the driver to contact their insurance company because they may be able to provide assistance in identifying the owner of the automated vehicle and will take legal action against the other carrier (or manufacturer) if warranted.

Quinn says this advice also applies to pedestrians or cyclists who are involved in a hit-and-run incident or collision with an automated vehicle.

*Editor’s Note: Many terms have been used for self-driving cars, including autonomous vehicles, connected cars, driverless vehicles, highly automated vehicles and self-driving cars. We have elected to follow the lead of the U.S. Department of Transportation, which refers to these cars and trucks as automated vehicles. For reference, visit https://www.transportation.gov/AV.