Insurance for Uber, Lyft, and other Transportation Network Companies (TNC)

Companies like Uber, Lyft, and other Transportation Network Companies (TNC) offer excellent opportunities to earn a living or bring in some extra cash.

While these app-based, on-demand ride services provide drivers perks like flexible hours, TNCs don’t provide full coverage insurance to drivers who get into an accident. Whether you provide “ride-hail” services, where someone requests a ride for themselves and their own party, or “rideshare” services where someone can share a ride with another party going to a similar destination (for example, Uber Pool and Lyft Shared), Mercury has you covered. To explain how, we’re going to just use the term “rideshare,” but our insurance works for both, all for as little as $0.90 a day.1

How Rideshare insurance works

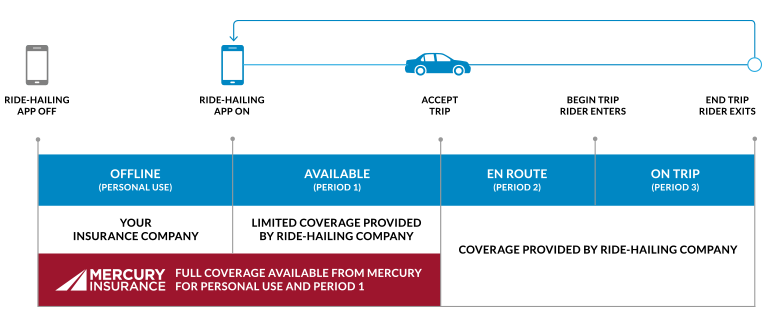

When driving for a TNC, their commercial insurance policy kicks in once you accept a fare or are transporting a passenger. However, the commercial TNC policy only provides limited insurance coverage when your rideshare app is on but you haven’t accepted a fare (Period 1 in the graphic above). Rideshare insurance from Mercury protects you and your vehicle in the event of a covered loss during this time.

It’s important to understand that, without the rideshare endorsement, your personal auto insurance policy only provides coverage when your TNC app is off.When your app is on, and you're looking for a fare, you may not have coverage.

What Does Rideshare Insurance Not Cover?

Rideshare insurance is a great way to fill coverage gaps, but it doesn’t cover everything. This type of insurance doesn’t cover the following scenarios:

- When you’re offline: When your rideshare app is off, you use your car like any other driver. That means your personal auto insurance applies, and rideshare insurance isn’t needed during this time.

- After you’ve accepted a ride request (Period 2): Once you accept a fare, the TNC’s commercial insurance policy takes over as the primary coverage. Mercury’s rideshare insurance doesn’t replace or extend the coverage provided by Uber, Lyft, or other rideshare companies during this time.

- When you have a passenger in the car (Period 3): Mercury’s rideshare insurance doesn’t apply once you have an active ride in progress. Instead, the rideshare company’s commercial insurance takes over as the primary coverage.

Where Is Rideshare Insurance Available?

Mercury provides rideshare insurance in the following states:

- Arizona

- California

- Florida

- Georgia

- Illinois

- Nevada

- Oklahoma

- Texas

- Virginia

However, rideshare insurance is not available in New York and New Jersey.

If you’re driving in a covered state, contact us for a rideshare auto insurance quote today.

Mercury Has You Covered

Our rideshare coverage2 can help fill liability gaps and provide you with premium insurance that gives you excess coverage when the TNC coverage isn’t in effect. If you get into an accident and you’re liable, Mercury Insurance will pay to fix the damage to the other vehicle(s), cover any resulting injuries, and take care of having your car fixed at one of our authorized repair facilities.3

Call us at (855) 965-5917 or click below for a fast, free online quote!

1Actual cost may vary, depending upon coverage selected and other underwriting factors. Purchase of a Mercury auto policy at an additional cost is required.

2Coverages may vary and are not available in all states.

3Subject to policy limits and eligibility requirements. Mercury coverage is secondary to Ride-Hailing company coverage.

Top Rated Insurance

Mercury Insurance has been helping drivers stay protected on the road for decades with affordable rates, reliable coverage, and high-quality customer service. We know that finding great insurance at a great price matters, which is why so many drivers continue to choose Mercury year after year.

Read real customer reviews to find out what they love about Mercury!

Learn More About Insurance

Interested in learning more about car insurance? Explore our blog for helpful information and advice:

Rideshare Insurance FAQs: You have questions and we have answers.

What Does TNC Stand for?

TNC stands for transportation network company, and includes Uber, Lyft and Sidecar and other ride-hailing companies that provide app-based, on-demand ride services. TNC drivers use their personal vehicles for commercial activities to transport passengers from one place to a set destination. They respond to requests via mobile technology when they are available to accept passengers (i.e., their TNC app is on).

How does the insurance industry define the stages of how a TNC driver is using his or her personal vehicle?

Much of the industry has adopted California’s definitions at this point. They are:

Personal: You’re driving the private vehicle for personal reasons, and the TNC app is off.

Period 1: You’re driving the private vehicle, and the TNC app is on.

Period 2: You’re driving the private vehicle, the TNC app is on and you’ve accepted a passenger but haven’t picked him or her up yet.

Period 3: You’re driving the private vehicle and transporting the passenger(s), or the passenger(s) has arrived at the destination and is exiting the vehicle.

Does my personal auto insurance cover me if I’m an Uber of Lift driver?

Personal auto insurance coverage only applies when you are using your vehicle for personal transportation. Personal auto policies don’t provide coverage when transporting passengers for hire, which includes Periods 1, 2, and 3 above. Most personal policies specifically exclude this type of activity, which means you probably won’t be covered if you get into an accident.

Do I need to get additional auto insurance coverage if I’m an Uber or Lyft driver?

Yes. Personal auto insurance policies do not cover commercial driving (i.e., working for hire to transport passengers) nor do TNC companies cover personal driving; leaving a potential gap in insurance for ride-hailing drivers during Period 1 of the paying passenger cycle. This means that if drivers get into an accident during Period 1, they may have to pay to repair any damage to their vehicle. Also, the TNC liability coverage, for bodily injury or death, is capped at $50,000 per person and $100,000 per accident during Period 1. For property damage resulting from an accident, the amount of coverage available will be $30,000. These limits may vary by state. If the ride-hailing operator’s personal auto insurance policy includes coverages beyond these limits, those additional amounts will likely not apply.

When does Mercury’s rideshare insurance come into play?

Mercury’s ride-hailing coverage will fill the gaps and provide you with high quality insurance that will cover you in Period 1 of the drive cycle, when the ride-hailing app is turned on and you have not accepted a fare. When this is combined with the TNC’s commercial insurance coverage, it provides you with protection through all stages.

How does Mercury rideshare insurance protect the policyholder?

Mercury ride-hailing coverage fills in the gaps during Period 1 of the drive cycle when your personal auto policy and the TNC commercial coverage don’t protect you. If you get into an accident and you’re liable for the damages, Mercury will pay up to the policy limits to fix the damage to the other vehicle(s) along with any resulting injuries up to your policy limits. Mercury will also pay to have your vehicle fixed, depending on the terms of the policy. These coverage limits are secondary to any applicable ride-hailing company coverage during Period 1 of the TNC transaction.

What is the cost of Mercury’s rideshare insurance?

The cost will vary depending on the amount and type of coverage you select. Drivers must have a Mercury personal auto insurance policy to add ride-hailing coverage, and the ride-hailing insurance can cost as little as 90 cents a day, depending on your policy premium.

Are there any restrictions on who is eligible for Mercury rideshare insurance?

You must have a Mercury personal auto policy to be eligible for Mercury’s ride-hailing insurance.

What is the minimum coverage required by Mercury for a TNC driver to have a rideshare policy?

The law requires a TNC’s commercial policy to cover ride-hailing drivers as their primary coverage when engaged in ride-hailing activities. Mercury policies do not require minimum coverage.

Can I cover more than one vehicle with Mercury’s rideshare insurance?

Yes, as long as you have a Mercury personal auto insurance policy for those vehicles, too.

Does the Mercury rideshare policy cover me if I drive another vehicle?

You must include the other vehicle to your Mercury personal auto policy and add the ride-hailing coverage to ensure you, your passengers and the car have protection in the case of a covered loss while using the vehicle in TNC activities.

If I have multiple vehicles, can I choose which ones to add to the TNC policy coverage?

The ride-hailing insurance coverage will only be added to the vehicle(s) that you operate as a TNC driver. This allows you to retain one policy for all of your vehicles, and just add the TNC coverage where needed. Please inform your Mercury agent or representative which vehicle(s) you operate as a ride-hailing driver to be sure you have the correct coverage.

Who does the Mercury rideshare policy cover?

The Mercury ride-hailing insurance policy covers the named TNC driver and any passengers in the car. If you have additional family members listed as drivers of the vehicle, they have coverage from the personal auto policy. If they are ride-hailing drivers of the vehicle, too, you’ll need to add them to your Mercury ride-hailing insurance endorsement.

Does rideshare insurance apply to delivery services like Uber Eats and DoorDash?

Rideshare insurance can extend to delivery services like Uber Eats and DoorDash. However, the exact coverages may vary by state. Contact us at (855) 965-5917 for more information.

How Do I Know If I Have Comprehensive Coverage?

How Do I Know If I Have Comprehensive Coverage? What to Do After a Car Accident: A Step-by-Step Guide

What to Do After a Car Accident: A Step-by-Step Guide Types of Car Accident Types & How to Avoid Them

Types of Car Accident Types & How to Avoid Them