Our Story

Trusted by millions of drivers since 1962.

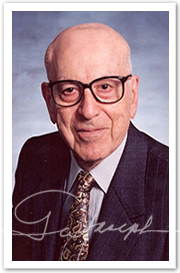

A Vision of the Future

George Joseph founded Mercury Insurance on the belief that he could offer consumers quality insurance products at affordable rates and combine that with top-notch customer service.

And more than 60 years later, this vision is still very much a part of the way we do business today.

Mercury Milestones

Download Mercury Milestones(PDF file) (6mb)

1962

Sold first policy

- Mercury General Corporation, founded by Mr. George Joseph, sells its first policy

- We began with just six team members and 90 agents

1970

$1 million in written premium in a single month

1972

Mercury begins selling homeowners insurance

1978

Establishes insurance industry’s first Special Investigations Unit (SIU) to fight insurance fraud

Mid 80s

Largest PPA in CA

Mercury becomes the largest independent agency writer of private passenger auto insurance in California

1985

Initial public offering

Mercury goes public at $19/share

1989

Georgia and Illinois expansion

1996

-

Listed on New York Stock Exchange for trading

-

Oklahoma and Texas expansion

1997

$1 billion in annual net premiums written

1998

Florida expansion

2001

New York and Virginia expansion

2003

-

New Jersey expansion

-

$2 billion in annual net premiums written

2004

Arizona and Nevada expansion

2006

$3 billion in annual net premiums written

2009

Acquires Auto Insurance Specialists (AIS)

2012

Celebrates 50th anniversary

2013

Named by Forbes as one of America’s Most Trustworthy Companies

2015

Acquires Workmen’s Auto Insurance Company

2016

Named by Forbes as one of America’s Most Trustworthy Financial Companies for the 3rd time!

2019

Launches Home Cyber Protection for homeowners, condo owners and renters

2020

-

Launches MercuryGO usage-based insurance program in Texas

-

Rolls out Mercury Giveback Program, returning $128M to policyholders during COVID19

2021

-

Named Best Insurer for Overall Satisfaction in the Shopping Segment of the J.D. Power 2021 U.S. Digital Experience Study

-

Named by Forbes as one of the Best Insurance Companies in America for 2022.

-

Expands MercuryGO to Florida, Georgia and Oklahoma