Californians save an average of $1,008* with Mercury Auto Insurance

Enter your zip code below to start your quote

Welcome back!

You can pick up from where you left by retrieving your quote below.

Search by Quote ID → Search by Date of BirthOur Customers Say

We have been with Mercury with both car and homeowner insurance. Always very helpful with any questions or any changes necessary. Even when we have had claims they are always very helpful. Would not change for any other company.

Martha A, Whittier

The thing I like most about it, is mercury saved me 514 dollars over a one year period!!

John, Jacksonville

I was with Progressive for over 14 years and they kept rising my rates switched to Mercury and saved almost $100 a month.

Scott, Fontana

Love how affordable it is and how easy it was to get my auto insurance all set up.

NeeNee, San Bernardino

Swept my worries away with great customer service. Answered all questions thoroughly, making me quite satisfied.

Scott, North Hollywood

I've had Mercury for a long time, and whenever I've needed them, they took care of everything, no hassles, and I always feel like I'm getting a fair deal.

Eric, Garden Grove

Needed car insurance but no time to visit an agent. Set everything up online in about 30 minutes. Could not have been easier.

Tanya, Coweta

Had an accident claim this year. Was treated very well from start to finish. All staff were great and very professional. Thanks Mercury.

Ernest, Oakland

I feel secure knowing I am in good hands with Mercury. I like having Mercury on my side. They are a very progressive insurance company that makes me feel protected statewide.

Feel Safe, Orange County

Best quote on Auto. And easiest online service and registration and app of any of the others!!!

Gulleys7, San Diego

My agent was funny, friendly, and in fact, I bought renter's insurance and then upgraded my auto at the advice of the agent. They were both very professional.

Julie, Long Beach

Mercury Alerts

World’s Best Insurance Companies in 2023: Forbes Recognizes Mercury Insurance

Forbes partnered with Statista to survey 30,000 policyholders in 15 countries and found Mercury as one of the best insurance companies in the world.

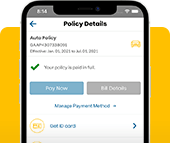

Our app puts you in the driver seat. Download it today!

Our easy-to-use app lets you stay connected wherever you go – 24/7. Get instant access to your digital ID cards, make policy changes, and much more!

Report a Claim

Get the assistance you need by filing a claim online 24/7 or call the claims hotline at (800) 503-3724.

Why choose Mercury?

24/7 Claims

You can file a claim 24 hours a day, seven days a week with Mercury’s automated digital experience, or call (800) 503-3724.

Learn More about ClaimsGuaranteed Repairs

We guarantee any repairs completed by a Mercury authorized repair shop for as long as you own the car!

Find a Repair ShopDedicated agents

You will receive dedicated service from a local agent who will work to find you the best available rate and coverage.

Find an AgentHelpful Resources

Insurance advice, money saving ideas, safety measures, and more.

Mercury is here to help with all sorts of resources and tips.

*Savings info. based on 2024 CA Department of Insurance rate comparison 255B. Individual savings may vary.